As we move further into the digital age, automating your banking processes can save time, reduce errors, and enhance security. With technological advancements rapidly transforming financial services, staying updated with the latest tools is essential. Let’s explore five key ways you can automate your banking in 2025.

Integrate AI-Powered Personal Finance Assistants

AI-powered personal finance assistants are transforming the way we manage our finances. By integrating these tools into your banking routine, you can enjoy tailored financial advice, spending insights, and budgeting assistance. These virtual assistants use machine learning to analyze your spending habits, suggest savings opportunities, and even optimize your investment strategies.

Enhancing financial decision-making is just the beginning. With AI assistants, you can automate routine tasks like bill payments and account monitoring. This technology not only saves time but also reduces the risk of human error. For more insights on budgeting and automation, check out Budget Besties Podcast.

Utilize Automated Savings Tools

Automated savings tools are an excellent way to ensure you consistently set aside money for future goals. These tools analyze your spending patterns and automatically transfer small amounts into savings accounts. This “set it and forget it” approach helps build a savings habit without requiring constant attention.

Some platforms even offer round-up savings features, where transactions are rounded up to the nearest dollar, and the difference is saved. This feature can be an effortless way to accumulate funds over time. By leveraging these tools, you can enhance your financial security and make saving a seamless part of your everyday life.

Set Up Smart Payment Alerts

Smart payment alerts are essential for maintaining control over your finances. By setting up notifications for upcoming bills, low balances, or suspicious transactions, you can avoid late fees and overdraft charges. These alerts can be customized to fit your unique financial needs and preferences.

Utilizing budgeting apps that offer these alert features can further streamline your financial management. By staying informed, you can make timely decisions and maintain a healthy financial status.

Leverage Blockchain for Secure Transactions

Blockchain technology is revolutionizing secure transactions in the banking industry. By using blockchain, you can ensure that your transactions are transparent, tamper-proof, and efficiently verified. This decentralized ledger system reduces the risk of fraud and enhances the security of your financial data.

Incorporating blockchain into your banking practices can simplify cross-border payments and expedite transaction processes. With more financial institutions adopting this technology, it’s becoming a critical component of a modern banking strategy. For a deeper understanding of blockchain’s impact, explore this research article.

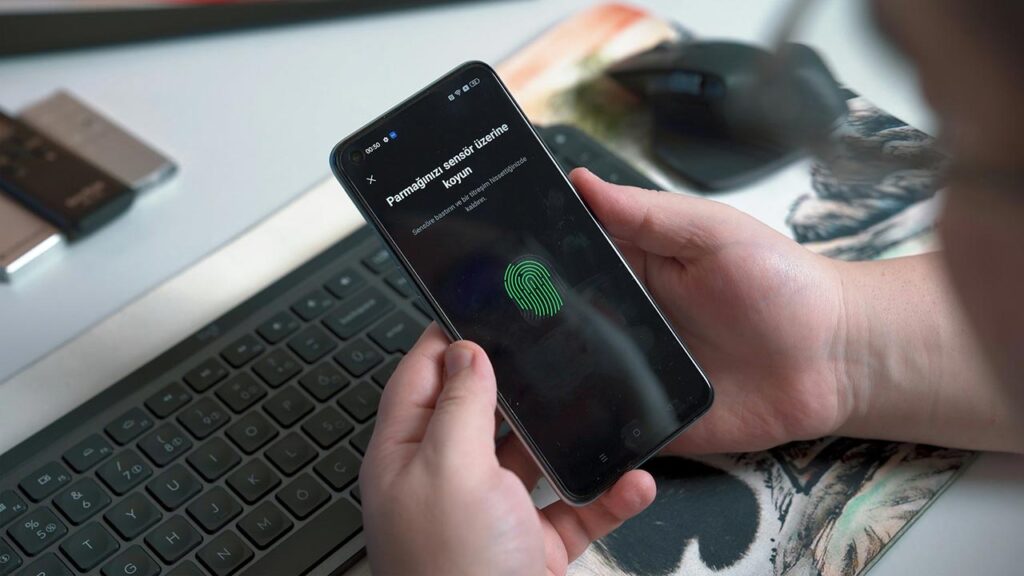

Embrace Biometric Authentication Technologies

Biometric authentication technologies, such as fingerprint and facial recognition, are enhancing the security of online banking. By utilizing these technologies, you can protect your accounts from unauthorized access while making the login process faster and more convenient.

Embracing biometric authentication not only fortifies your financial security but also aligns with the growing demand for seamless user experiences. As more financial institutions incorporate these technologies, the need for traditional passwords may diminish, offering a more secure and efficient way to manage your finances.

Leave a Reply