Understanding where to locate the account number and routing number on a check is essential for anyone managing personal or business finances. These numbers are crucial for executing various financial transactions, such as direct deposits or automatic bill payments. This article will guide you through identifying these numbers on a check to help you manage your finances more effectively.

Understanding the Basics of a Check

Checks are composed of several key components, each serving a specific purpose in facilitating financial transactions. The payee line is where you write the name of the person or entity to whom the check is payable. The amount box is where you numerically indicate the amount of money the check represents, while the amount line allows you to spell out the same amount in words for added clarity. The memo line is an optional space where you can note the purpose of the check, serving as a personal reminder or additional information for the recipient.

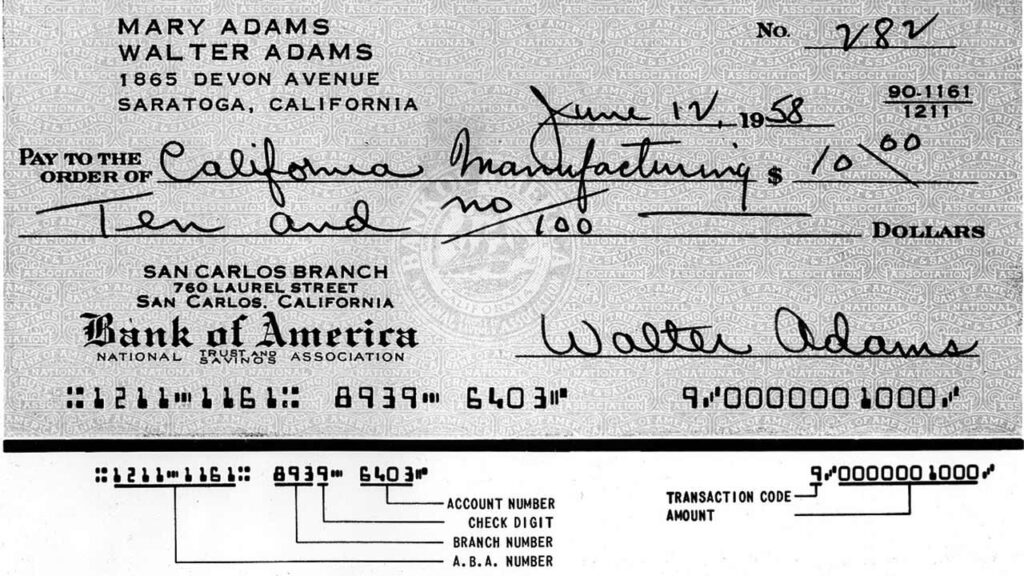

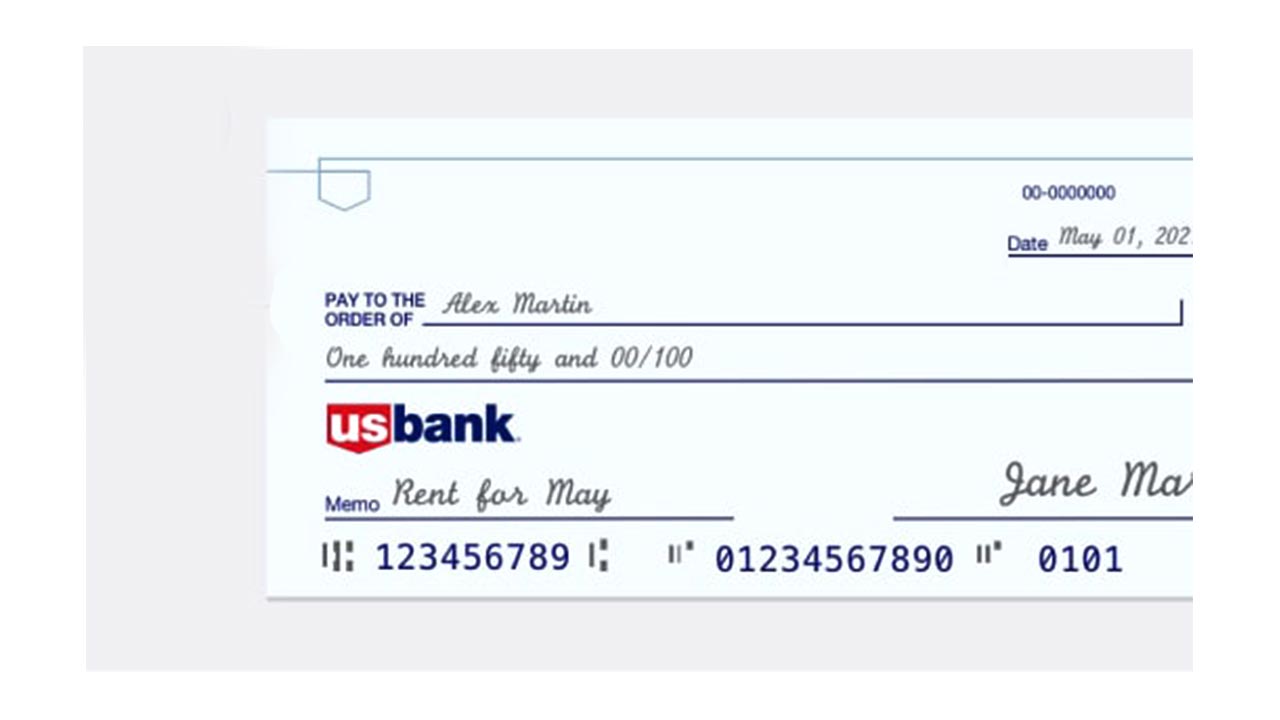

The account and routing numbers are essential elements on a check, playing a vital role in banking transactions. The routing number is a nine-digit code that identifies the financial institution responsible for processing the check, ensuring that funds are transferred accurately between banks. The account number, meanwhile, specifies the exact account from which the funds should be drawn, making it indispensable for secure and efficient transactions.

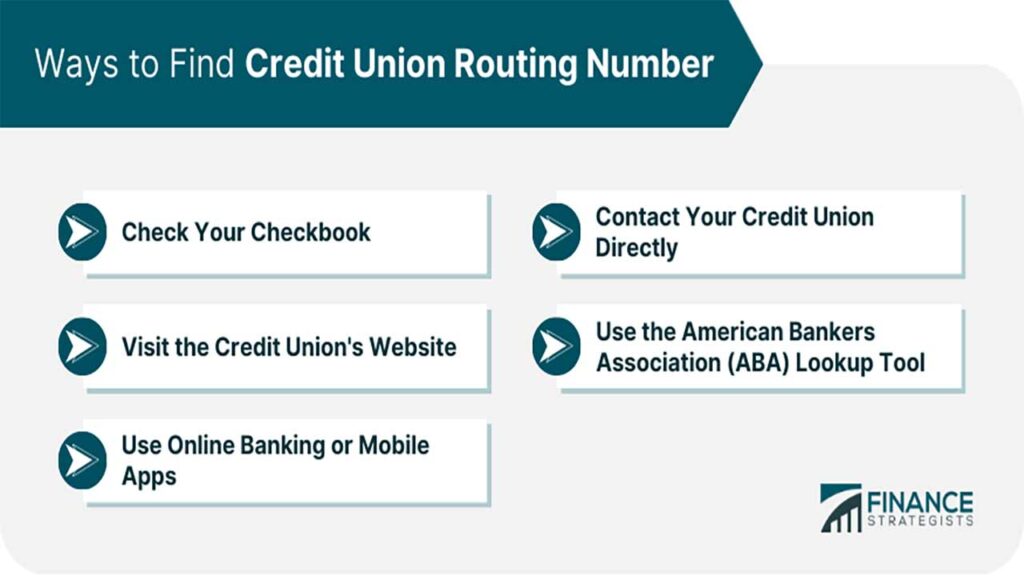

Locating the Routing Number on a Check

The routing number on a check is typically located at the bottom left corner. It is the first set of numbers you will encounter, usually printed in a slightly larger and bolder font. This placement is consistent across most checks, although variations can occur depending on the bank’s specific design or layout. It’s essential to familiarize yourself with the check design of your bank to locate the routing number quickly and accurately.

The routing number serves as a unique identifier for the bank that holds your account. This number is crucial for interbank transactions, acting as a financial institution’s address in electronic and paper-based transactions. By identifying the bank, the routing number ensures that checks are processed correctly, preventing errors that could delay or misdirect funds.

Finding the Account Number on a Check

The account number is usually located to the right of the routing number, following a space or special character. On most checks, it is the middle set of numbers at the bottom. Although the layout might vary slightly depending on the bank or check style, the account number’s position is generally consistent. It’s advisable to verify the layout with your bank if you’re uncertain about the correct placement.

The account number is critical in identifying the specific account associated with a check. Whether you’re depositing funds, making a withdrawal, or setting up an automatic payment, the account number ensures the transaction targets the correct account. This precision is vital in preventing errors and ensuring the seamless flow of funds in and out of your account.

Security and Privacy Considerations

Protecting your account and routing numbers is paramount to safeguarding your financial information. Avoid sharing these numbers unnecessarily, and always ensure that any party requesting this information is trustworthy. Consider using checks with security features like watermarks or security ink to deter unauthorized use. Regularly monitoring your account statements can also help you detect and address any suspicious activity promptly.

If your check is lost or stolen, it’s crucial to act swiftly to mitigate potential risks. Contact your bank immediately to report the incident, and request a stop payment on the missing check if possible. This proactive approach can prevent unauthorized transactions and protect your funds from fraudulent activity.

Common Mistakes and How to Avoid Them

One common mistake when handling checks is misreading the account and routing numbers. These numbers can be challenging to interpret, especially if the font is unclear or smudged. To avoid errors, take your time to read each digit carefully, and double-check them before using them in any transaction.

Using incorrect account or routing numbers can lead to significant complications, such as failed transactions or funds being sent to the wrong account. Always verify these numbers before proceeding with a financial transaction. Cross-referencing them with a bank statement or directly with your bank can help ensure their accuracy and prevent costly mistakes.

Leave a Reply