Diving into cryptocurrency can be an exciting but complex endeavor. Whether you’re a novice or an experienced investor, understanding how to effectively research and analyze different cryptocurrencies is crucial. Here are seven essential tips to guide your journey.

Understand the Basics of Blockchain Technology

Before delving into specific cryptocurrencies, it’s essential to grasp the fundamentals of blockchain technology. Blockchain is the underlying framework that supports all cryptocurrencies, and understanding its mechanics will provide you with a solid foundation. Familiarize yourself with terms like decentralization, consensus algorithms, and smart contracts.

Reading introductory articles or watching educational videos can be beneficial. These resources help demystify the technology and prepare you to evaluate more complex aspects of individual cryptocurrencies. A clear understanding of blockchain will enhance your ability to make informed investment decisions.

Investigate the Cryptocurrency’s Whitepaper

A cryptocurrency’s whitepaper is a critical document that outlines the project’s purpose, technology, and roadmap. Reviewing a whitepaper will give you insight into the developers’ vision and the cryptocurrency’s potential impact. Look for clear objectives, innovative solutions, and realistic timelines.

While reading, consider the feasibility of the proposed technology and whether the project addresses a genuine market need. A well-structured whitepaper often indicates a serious and well-thought-out project, making it a crucial part of your research process.

Analyze the Development Team and Community

The success of a cryptocurrency often hinges on the strength and credibility of its development team and community. Research the team’s background, experience, and previous projects to assess their capability to deliver on promises. A transparent and reputable team usually inspires more confidence.

Additionally, evaluate the activity and engagement level within the cryptocurrency’s community. An active community can be a sign of strong support and potential longevity. Social media platforms, forums, and the project’s official channels are good places to gauge community sentiment.

Evaluate Market Performance and Trends

Understanding a cryptocurrency’s market performance and trends is crucial for any investor. Analyze its historical price movements, market capitalization, and trading volume. Websites like Bankrate offer valuable insights into these metrics.

Keep an eye on market trends to identify potential investment opportunities. Whether it’s a bullish or bearish market, staying informed about trends will help you make strategic decisions. Resources like Exploding Topics provide an overview of emerging patterns in the crypto space.

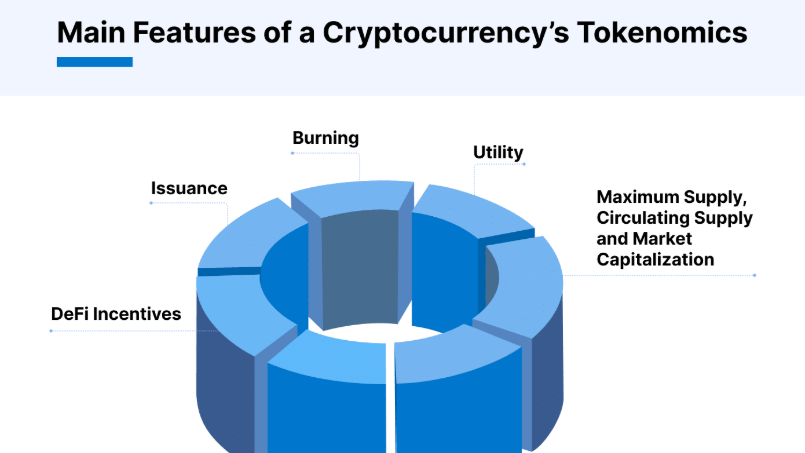

Assess the Cryptocurrency’s Use Case and Utility

A cryptocurrency’s use case and utility can significantly impact its value and adoption. Determine whether the cryptocurrency serves a unique function or solves a particular problem. Projects with clear and practical applications are more likely to succeed in the long term.

Consider how the cryptocurrency is being used in real-world scenarios and if it has partnerships or collaborations that enhance its utility. The more versatile and adaptable a cryptocurrency is, the more potential it has for widespread adoption.

Examine Security Measures and Protocols

Security is paramount in the volatile world of cryptocurrency. Assess the security measures and protocols in place to protect against threats. Look for information on encryption practices, consensus mechanisms, and past security incidents.

Cryptocurrencies with robust security measures are less susceptible to hacks and other vulnerabilities. Understanding these aspects will help you gauge the reliability and safety of a cryptocurrency before investing.

Review Regulatory and Legal Considerations

Regulatory and legal frameworks can significantly impact the viability of a cryptocurrency. Research the regulatory environment in which the cryptocurrency operates, as well as any legal challenges it may face. Governments’ stance on cryptocurrency can influence its adoption and market performance.

Stay updated on changes in regulations and consider the potential implications for your investments. Articles such as those on Springer provide detailed analyses of regulatory environments and their effects on the crypto market.

Leave a Reply