The housing market is a dynamic and ever-changing landscape, with trends that can make or break an investor’s portfolio. Grant Cardone, the renowned real estate mogul, is known for his ability to spot lucrative opportunities. This article explores the specific housing market trend he is capitalizing on and whether it could be a wise move for you as well.

Understanding the Current Housing Market Trend

One of the most notable aspects of the current housing market is its volatility. Recent shifts, driven by various economic and geopolitical factors, have created a landscape where prices fluctuate more than ever. Such volatility is influencing investment strategies, pushing investors to be more cautious and strategic in their decisions. The uncertainty surrounding the market can be both a risk and an opportunity, depending on how one navigates it.

Economic indicators such as interest rates and inflation play a significant role in shaping real estate investments. As interest rates rise, borrowing becomes more expensive, which can deter potential buyers and investors. Conversely, inflation can drive up property values, making real estate a potentially profitable investment. Understanding these factors is crucial for anyone looking to invest in the housing market today.

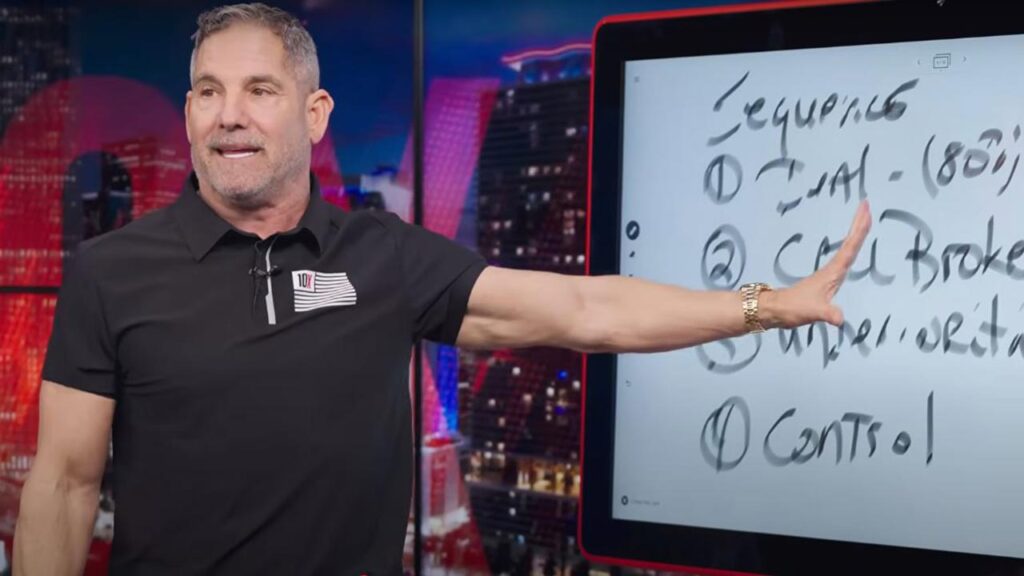

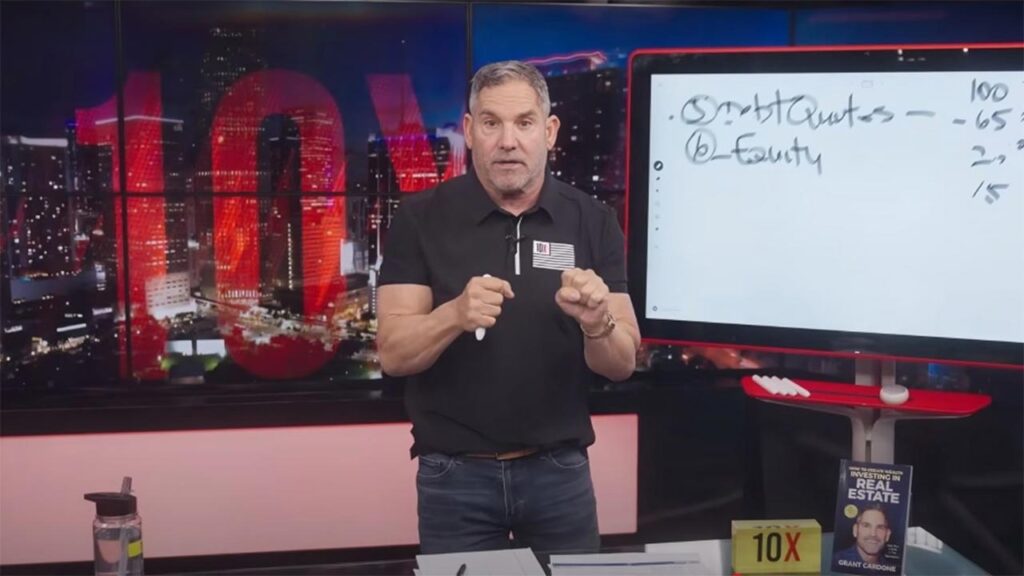

Grant Cardone’s Investment Strategy

Grant Cardone has made a name for himself by focusing on multi-family properties. He believes these properties offer more stability and potential for income generation compared to other types of real estate. By investing in multi-family units, Cardone can leverage a consistent cash flow from rent while benefiting from property appreciation over time.

Cardone’s strategy also involves balancing long-term and short-term gains. He understands the importance of immediate profits to maintain liquidity and fund future investments, while also focusing on the long-term growth potential of his real estate portfolio. This balanced approach allows him to capitalize on current market conditions without losing sight of future opportunities.

Benefits of Following Cardone’s Approach

One of the key benefits of Grant Cardone’s investment approach is diversification. By investing in a range of multi-family properties, he mitigates risk and ensures a steady income stream. This diversification is crucial in the current volatile market, as it helps shield investors from potential losses in any single property or area.

Another advantage is the ability to leverage expert knowledge. Cardone’s extensive experience and success in real estate provide valuable insights for individual investors. By aligning with expert-led investment strategies, individuals can benefit from proven methods and potentially increase their investment returns.

Potential Risks and Considerations

While there are benefits to following Cardone’s strategy, potential risks must also be considered. The real estate market is highly competitive, and entering a saturated market can pose significant challenges. Investors need to be aware of the competition and be prepared to adapt their strategies accordingly to succeed.

Another critical consideration is the financial commitment and liquidity constraints inherent in real estate investments. Real estate requires significant capital, and investments can be less liquid compared to other asset classes. Understanding these financial commitments and planning accordingly is essential for anyone considering this investment path.

Should You Adopt This Strategy?

Ultimately, whether or not you should adopt Grant Cardone’s strategy depends on your personal financial goals and risk tolerance. It’s important to assess your own objectives and determine if this approach aligns with your investment philosophy. Real estate investing is not a one-size-fits-all solution, and what works for Cardone may not necessarily work for everyone.

Consulting with financial advisors is another crucial step before making any significant investment decisions. Advisors can help tailor investment strategies to your individual needs and circumstances, ensuring that you make informed decisions that align with your long-term financial goals.

Leave a Reply