Saving $10,000 in a year is an achievable goal if you approach it with a clear plan. By making small, deliberate changes to your financial habits, you can reach this milestone. Here are ten steps to help you on your journey to saving $10,000 in just one year.

1) Set Clear Financial Goals

First, I need to set clear financial goals. Knowing why I want to save $10,000 will keep me motivated. Whether it’s for a vacation, an emergency fund, or a big purchase, having a specific goal will guide my savings plan.

r/Frugal / Pexels

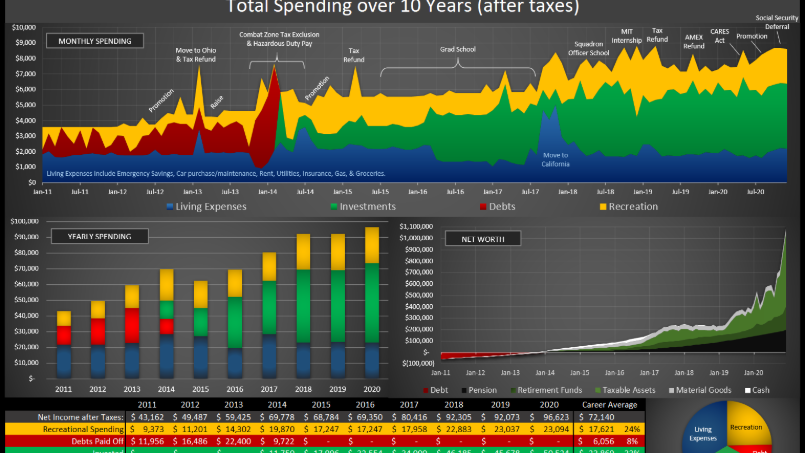

To understand where my money is going, I’ll start tracking my expenses. Using apps or spreadsheets, I can categorize my spending and identify areas to cut back. This will give me a clear picture of my financial habits and help me find opportunities to save.

3) Create a Monthly Budget

With my expenses tracked, it’s time to create a monthly budget. I’ll allocate funds for necessities and savings first, ensuring I prioritize my financial goals. This structured approach will keep my spending in check and maximize my savings potential.

4) Cut Unnecessary Subscriptions

Reviewing my subscriptions is essential. I’ll cancel those I rarely use or can live without. Streaming services, gym memberships, and magazine subscriptions can add up quickly. Trimming these expenses will free up more money for my savings goal.

5) Automate Your Savings

To ensure I consistently save, I’ll set up automated transfers to my savings account. By treating savings like a non-negotiable expense, I won’t be tempted to spend the money elsewhere. This step makes saving effortless and helps me stay disciplined.

6) Reduce Dining Out and Cook at Home

Eating out can quickly drain my budget, so I’ll focus on cooking at home. Meal planning and preparing lunches can significantly reduce my food expenses. Not only will this save money, but it will also encourage healthier eating habits.

7) Use Cashback and Coupon Apps

I’ll take advantage of cashback and coupon apps to save on everyday purchases. These tools offer discounts and rewards that add up over time. By being a savvy shopper, I can stretch my dollars further and contribute more to my savings.

8) Embrace a Minimalist Lifestyle

Adopting a minimalist lifestyle can simplify my life and boost my savings. I’ll focus on buying only what I truly need and declutter items I no longer use. This mindset shift will reduce impulse spending and help me appreciate what I already have.

9) Find Additional Income Streams

Exploring additional income streams can accelerate my savings. Whether it’s a side hustle, freelance work, or selling unused items, extra income can make a significant difference. I’ll leverage my skills and resources to find opportunities that fit my lifestyle.

10) Review and Adjust Your Plan Regularly

Finally, I’ll regularly review and adjust my savings plan. Life changes, and so do financial priorities. By assessing my progress and making necessary adjustments, I can stay on track to achieve my $10,000 savings goal.

Leave a Reply